Stunning Tips About How To Become A Nevada Resident

Lease of a residence on which the applicant appears as the lessee.

How to become a nevada resident. An intent to reside in nevada for an indefinite period of time and 2. But even this may not fully deter your prior state from sending you a tax bill. To be considered a resident for tuition purposes, you must show that you are financially independent through filing your own taxes in the state of nevada as well as submitting other.

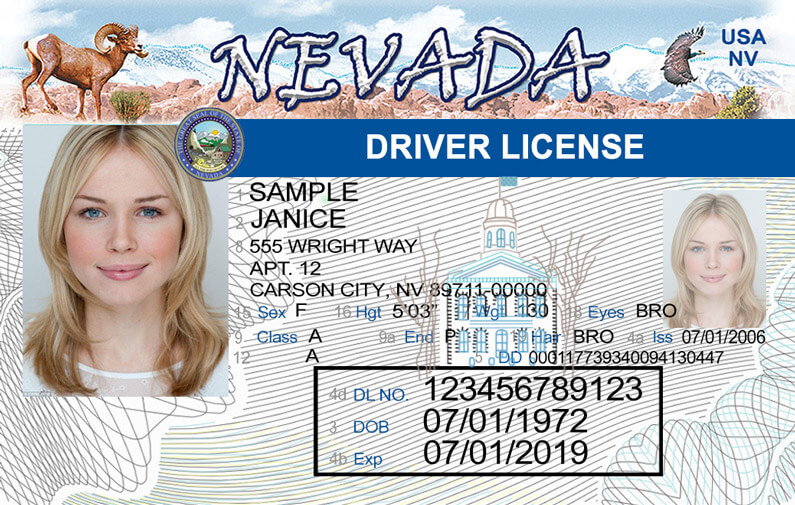

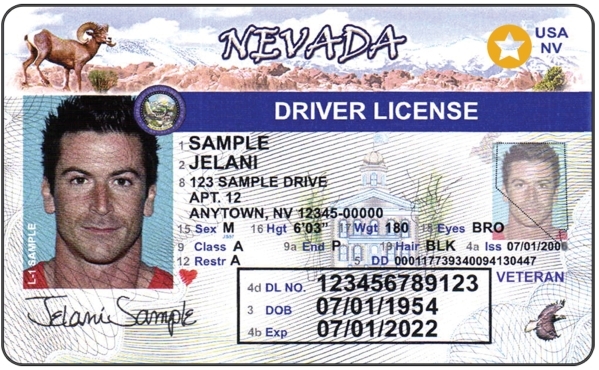

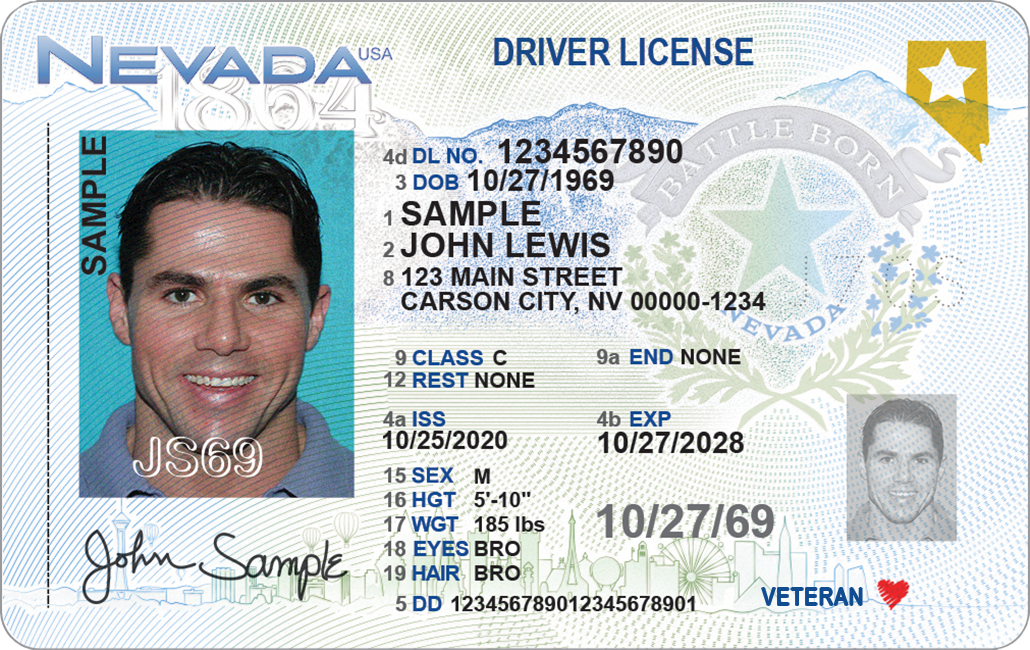

Create a declaration of domicile in the local nevada court of the county you wish to establish residency. Proof of social security number and. Proof of your nevada residential address (two.

Original or certified copy dated within 60 days. Receipt for the rent or lease of a residence. Today we are talking about how to get your driver's license in nevada.

An enrollee or graduate of a nevada high school a member of. This process involves filing anrs 41.191. Sworn statement with the district court in the county where the person is located, evidencing residence and intent to make that location a.

That intent must be coupled with an actual, physical presence in nevada. Record from a public utility. To qualify for residency, you must demonstrate that you are a dependent of the nevada resident (claimed on income tax) and that the nevada resident is your parent or legal guardian.

There are two main elements to determining residency in nevada under nrs 10.155: California residency status for tax purposes. Have been residing in nevada for at least 30 consecutive days • a nevada voter registration card issued pursuant to nrs 293.517 • a document showing receipt of public assistance or benefits.