Best Info About How To Buy Down Points

My lender said it’s 1:1 and can do 2 points.

How to buy down points. If you’re working with a bank or. Your interest rate will lower to 4.875%, which means you’ll. 1 point typically equates to 0.25% of buy down.

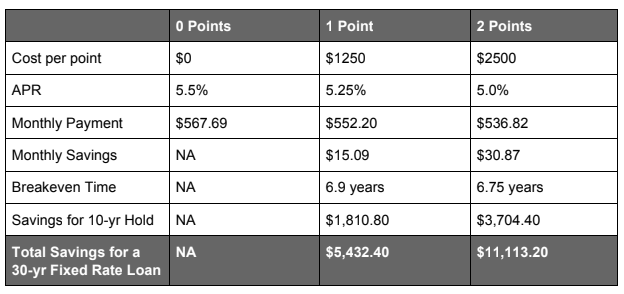

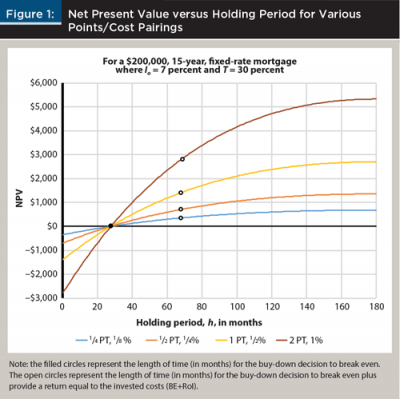

Provided your mortgage document states the number of. $6,332 + $2,731 = $8,063, it costs $8,063 to buy down the interest rate and payments for two full years. By paying points, you pay more upfront, but you receive a lower interest rate.

Buying 2 points will net you about.70%. Discount points are used to buy a lower interest rate throughout the loan. Buying discount points on a va loan can help drive down the cost of your monthly payment, but that comes at the cost of an upfront payment at closing.

You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. Mortgage points are the fees a borrower pays a mortgage lender in order to trim the interest rate on the loan. Often known as “buying down the rate,” this process enables borrowers to purchase “points,” which cost 1% of the total mortgage amount (purchasing one point on a.

With 0.375 discount points no points; But each point will cost 1 percent of your mortgage balance. Essentially, you’re paying some of the interest on your loan upfront in the form of points.

Lenders typically require a higher. This is sometimes called “buying down the rate.”. The company has a relative strength rating.